Canadians are paying high at gas stations

Oil prices are surging as Russia continues its war on Ukraine.

Consumers around the world are now concerned about this ongoing price spike.

Russia’s oil industry- a vital source of its revenue- is already showing signs of a slowdown as western buyers shun their trade with Russia.

Despite its many political angles, for consumers around the world, this crisis is mainly a question of oil prices at their nearby gas stations. As the international oil climate is constantly evolving, our team conducted a detailed study on related historical trends and talked to experts in an effort to find the best possible answers to questions surrounding this crisis.

What Do Experts Say?

We interviewed Dan McTeague, a former Ontario Liberal MP and the president of Canadians for affordable energy and Arne Kislenko, history and international relations professor at the University of Toronto.

President, Canadians for affordable energy

Professor, University of Toronto

“Canada could easily provide the oil that Russia is going to be pretty much sealed off from exporting at least to NATO/OECD European countries.” -Dan McTeague

“I don’t see there was any alternative for Western nations, you know, for the world to put sanctions on Russia that had to be done and it will have a sobering effect on the Russian economy overall, that could be a good thing and sort of unhinging Putin, but it is going to make the Russian people pay the price and the effects of that are not absolutely clear. ” – Arne Kislenko

Watch the following video for more in-depth insight.

After Russia invaded Ukraine on February 24, 2022, many global nations placed sanctions on Russia as a penalty for its breach of international order.

While these sanctions are in place, experts predict that they might even permanently impact Russia’s economy.

But in reality, this is only one-half of the story, and the other half concerns global nations, including Canada and the United States.

According to a source, Canada imported 3% of its crude oil in 2019 from Russia but has not purchased any since then.

Like many others worldwide, Canadian consumers too are already paying high oil and gas prices.

While this continues, the West is in a rush, searching for answers to solve this worsening crisis.

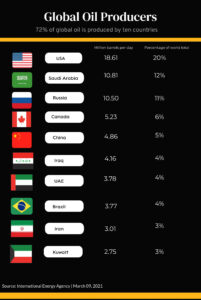

Russia is the largest exporter of natural gas and the second-largest exporter of crude oil. But the current war is causing a supply chain disruption as the world has suddenly lost Russia’s healthy influx of nearly 5 million barrels of oil per day.

As a result, after Russia invaded Ukraine, gas prices went up past $100, the first triple-digit price in 8 years.In March 2022, the average gas price in Canada was about 175 cents per litre, nearly 20 cents more than in February.

Despite Putin’s claim that the invasion of sovereign Ukraine is an attempt to “demilitarize and de-Nazify Ukraine,” there are strong voices of disagreement from the different parts of the world.

"Much of the war effort has been in part-financed by the Russian oil and gas industry, which made the nation $119 million dollars (USD) in revenue for 2021," says experts.

Oil Price Per Barrel in Canada - 50 Years Timeline

Future of Oil & Gas Prices

But has the global community done enough in their efforts to stop this war? Some say no.

In a recent appraisal of the ongoing conflict in Ukraine, Andrey Illarionov, a former policy advisor to Vladimir Putin, said the war could be stopped with a complete embargo on Russian oil & gas "within a month or two."

In March, President Biden promised to protect Ukraine. But experts say that the access to oil supply will remain limited.

The current trends of higher oil prices hit Canada's economic growth, with people having to spend more at gas stations. This means that the nation could only reduce costs in other areas to cut into the GDP.

In reality, international trade with both Ukraine and Russia has been affected. As the situation evolves, for countries including Canada and the United States, this will remain a headache trying to overcome inflation.

This means that for Canada and the rest of the world trying to recover from the ongoing effects of the pandemic, the oil prices are more likely to go up further before they come down.

Be the first to comment