By, Roshan Singh

“Government needs to shock people already have enough expenses,” says a student from Seneca College.

“Help other communities but help us Canadians also,” says another student

The inflation rate broke all the records this year, in June it was at 8.1% which was the highest since 1981. This is forcing Canadians to change their habits. People are forced to buy cheaper goods.

`Inflation and the high cost of living have impacted everyone. A study by Nanos Research for Canada’s CTV News involving more than 1000 Canadians says 61% have admitted to using a “cost-saving option” to save on food purchases as inflation stands at 6.9%. People are taking various steps to fight inflation.

There are various factors affecting the inflation rate in Canada. Stephanie Hughes who is a financial reporter at Financialpost.com says “the high rates are a result of supply chain problem which was caused by the Russian invasion into Ukraine”.

“As well as the world trying to pursuit this zero COVID…”, she added.

What Canada is trying to do here is take out excess demand of the economy by raising interest rates so making borrowing costs higher, so the businesses invest less keeping all borrow less which will stimulates less to the economy. The goal is to bring access demand back into balance with the supply chain.

Food prices are still increasing at the same pace which is 11.4% higher in the decade. While gas prices are showing a different trend. They are increasing but at the same time, we can see a fall in the prices also.

People got more interested in the topic of inflation this year. Following are some data from Google Trends showing search interest in ‘inflation’ ‘ proves it.

Drought in different reason regions from where the supply comes which have been a challenge across the globe for supply. The best thing for Canada to do right now is to decrease the domestic inflation rate.

Every Canadian provincial government has a different approach to fight inflation and to help its residents. Quebec’s Finance Minister Eric Girard announced that as of December, the Quebec government will give out either $400 or $600 to individuals who qualify.

- $600 cheques will go to people who earned less than $50,000 in 2021

- $400 cheques will go to those who earned between $50,000 and $100,000 in 2021

How can you save?

It will be hard for people who are trying to figure out how they can save some bucks in this condition. Here are a number of ways that you can cut back

- Prioritize your budget according to your need. Try not to spend on things that you don’t need

- Try to find cheaper alternatives. In this way, you will buy what you want and also some money

- If you are planning to buy stocks, keep them in a long-term investment, not a short term

- Unsubscribe from unnecessary platforms like memberships of websites. Now there are many free alternatives

- Build an emergency fund. We all know that emergency funds can help us in times when we need money the most.

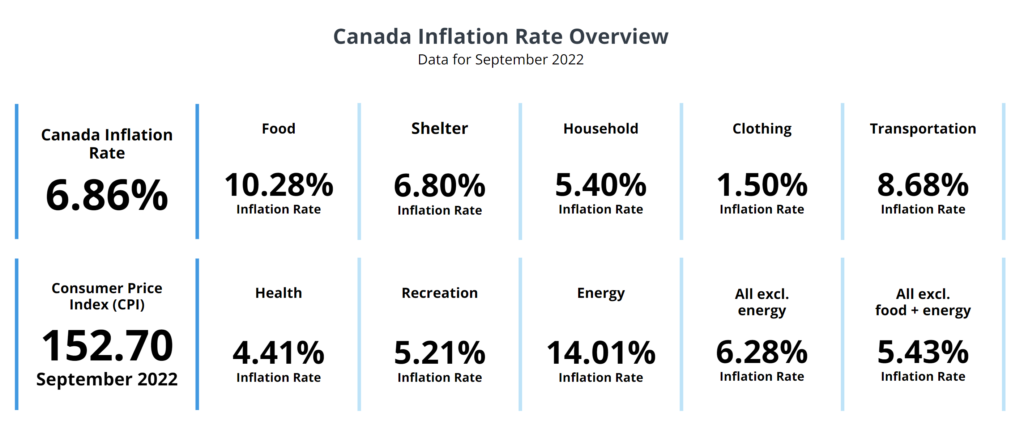

This is what Canada’s inflation was category-wise in September 2022. Credit: Wowa.ca (https://wowa.ca/inflation-rate-canada-cpi)

Possibility of recession

The unusual rise in price and unemployment grasped the country in the 1970s and as a result, Canada experienced a recession. Many experts and economists suggest that could happen again and Canada will see a recession next year.

RBC is predicting a quick moderate recession in the first half of next year. At the same time inflation is still expected to be much higher than the 2% target that the central bank had laid out.

Canadian are already getting hit by higher rates banks are still projecting a moderate recession in the next year where the inflation is still going to be high.

Inflation and recession are related. According to Forbes.com, a recession is caused by decreased customer spending, increased business costs, and reduced lending. Doesn’t allthis sound like what going on right now in Canada?

The best you can do is to take advice from a financial or budgeting expert.Some measures to make yourself recession-proof are budgeting, don’t spend too much and don’t spend on unnecessary things.

Be the first to comment